Why Invest in Boyd Group Services Inc.?

Why Invest in Boyd?

We think we are extremely well positioned to deliver shareholder value…

- We are a market leader/major consolidator in a highly fragmented auto collision repair industry in North America

- We have a strong balance sheet

- We enjoy favorable industry trends

- We operate in a recession resilient industry

- We provide for cash dividends

- And… we have a high ROIC growth strategy

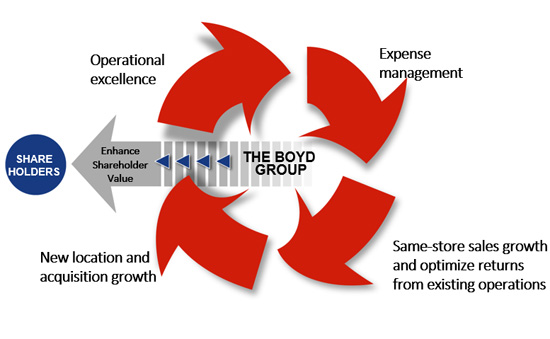

BUSINESS STRATEGY

Boyd’s primary strategy is to continue to focus on maximizing its opportunities through a commitment to:

- Expense management through a focus on cost containment and efficiency improvements;

- Optimizing returns from existing operations by achieving same-store sales growth and broadening product and service offerings;

- Operational excellence through a focus on being the best-in-class service provider and implementation of the WOW operating way;

- Doubling the size of the business beginning in 2021 by 2025, based on 2019 revenues. This implies and an average annual growth rate of 15%.

Expense Management

Boyd has achieved a reduction in operating expenses as a percentage of sales over the last number of years. By working continuously to identify cost savings and to achieve same-store sales growth, Boyd will strive to continue this trend. Operating expenses have a high fixed component and therefore same-store sales growth translates into a lower percentage of operating expenses to sales.

Same-Store Sales Growth and Optimize Returns from Existing Operations

Increasing same-store sales and running shops at or near capacity has a positive impact on financial performance. Boyd also continues to seek opportunities to broaden its product and service offerings in all markets to help grow same-store sales. During the last few years, the Company has focused energy and resources on increasing its share of the auto glass repair and replacement business.

Operational Excellence

Operational excellence has been a key component of Boyd’s past success and has contributed to the Company being viewed as a best-in-class service provider. Delivering on our customers’ expectations related to cost of repair, time to repair, customer service, quality and integrity are critical to being successful and being rewarded with same-store sales growth.

New Location and Acquisition Growth

Boyd will continue to pursue accretive growth through a combination of organic growth (same-store sales growth) as well as acquisitions and new store development. New location growth will include single location acquisitions, and brownfield and greenfield startups, as well as multi location acquisitions. Combined, this strategy is expected to double the size of the business and revenues (on a constant currency basis) beginning in 2021 over the next five years, implying an average annual growth rate of 15%. With prudent financial management and its strong balance sheet, Boyd is further well-positioned to take advantage of large acquisition opportunities, should they arise, which could accelerate the time frame to double its size. It is expected that this growth can be achieved while continuing to be disciplined and selective in the identification and assessment of all acquisition opportunities.

Boyd Group Services Inc.

1745 Ellice Avenue

Winnipeg, Manitoba, R3H 1A6

Email: info@boydgroup.com

Tel: 204-895-1244

Fax: 204-895-1283